Bitcoin – Maintaining New Range

document.addEventListener(“DOMContentLoaded”, function() { var elements = document.querySelectorAll(“.trendCard”); for (var i = 1; i < elements.length; i++) { element[i].addEventListener("click", function() { window.scrollTo(0, document.body.scrollHeight); }); }});

-

introduction

-

CTO Larsson Report

-

Tutorial: MetaMask

-

Appendix

introduction

To the amazing Ivan from the Tech & Moralis community,

Thank you for allowing us to serve you these TA dishes over the years.

Despite the success we’ve had, we’ve caught some major market moves in recent years. Perhaps thanks to my success, I am making some changes. Success is a dangerous place. That’s where you have to fight against complacency and instead freshen up your game.

We plan to change the content report format in 2024. So this is the final Friday TA report for this group. (And I plan to type it on Thursday.)

Happy New Year and congratulations to everyone who has been with us through this cycle.

I hope to see you on other channels too.

Cryptocurrency Market Overview and Analysis

TA Report – Thursday 28 December 2023 17:00 UTC

For those of you who are new to my analysis, I trade trends over the long term.

Global technology has only two outcomes. It’s either a huge success or a catastrophic failure. A skill either performs 100x with little in between or goes to zero. Asset prices exhibit long-term trends before reaching either endpoint.

My process aims to provide exposure during the duration of an established trend. This allows you to enter with more capital for a given risk compared to a hold-only approach. I’m not trying to catch the highs or lows. I don’t worry about movement during the day. My style of analysis is not suitable for day traders or range traders. When it comes to technology, capturing big moves over a long period of time can lead to big profits.

This is just a moment of analysis. Market structures can change in an instant. As new information becomes available, we will adjust our comments accordingly. Technical analysis of historical data is not intended to predict the future. This is a tool that can help you find favorable risk reward and void points.

It is for general information purposes only and not financial advice.

All information presented in this report refers to the opinions of the authors and is for general information purposes only. The information presented should not be construed as legal, tax, investment, financial or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any financial product. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek out a qualified professional in your jurisdiction who can take your specific circumstances into account. Past performance is not indicative of future results. You always run the risk of losing all your invested funds. I do not provide advice on buying or selling specific assets. Training and software tools are timeless and common across all assets. Rather than relying on subjective market opinions, we apply the principles of technical analysis established in the 1930s to historical charts. Anyone can apply the same process and get the same results. Technical analysis does not predict the future. A tool for finding settings for controlled risk/reward. The Larsson Line does not predict the future. Mathematical formula for expressing trends. The purpose of this report is to help you reflect on your own analysis, not to replace it.

expose: I have exposure to Bitcoin and Ethereum through corporate ownership and in my personal capacity as an ETP price tracking certificate through my bank.

fashion analysis

Bitcoin (BTC)

Have a new product line

Ethereum (ETH) and altcoins

An ETH/BTC follow-up is yet to be confirmed.

Bitcoin (dominant)

The trend line is broken

Bitcoin

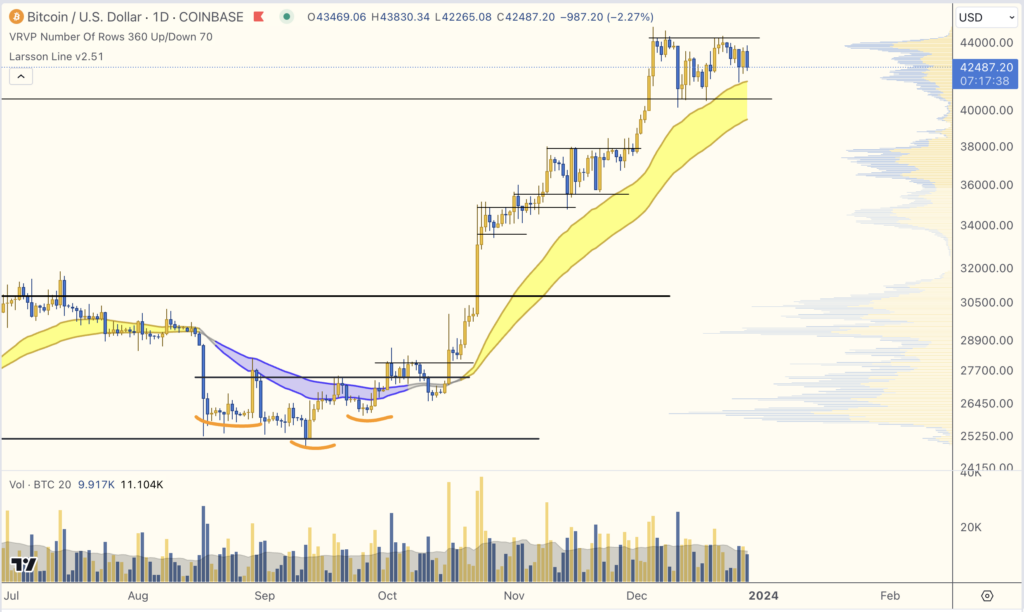

Bitcoin – Maintaining New Range

Last week’s analysis proved useful. Last Friday I wrote:

“… We can see that BTC/USD is now establishing a new range between approximately $40,600 and $44,300.

There were significant volume changes at the high end of this range (see Volume Profile).

A breakout of this range would be the next signal to look for. This could also be a resistance point for a retracement.”

This is exactly what we saw this week. And it still is.

The next short-term clue is the direction of a breakout of this range.

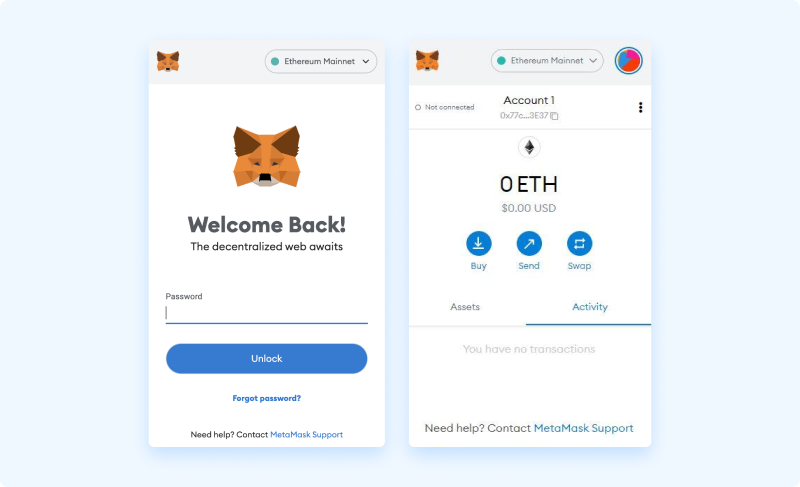

Web3 Wallet: Getting Started Guide

Metamask Wallet

This overview uses Metamask, the most widely used Web3 wallet and identity system. Alternative methods exist but are not described in this overview. For more detailed tutorials, visit the Moralis blog.

Level 1 Download and install Metamask wallet

The first step to getting started with Metamask is to install the browser extension wallet or mobile version for iOS or Android.

(The next steps will cover the browser extension version, but the steps are similar if you’re using the mobile option.)

Step 2 start

After downloading and installing, you will see the following options: [Get Started] .

Step 3 Import or create a new wallet

After selecting[Get Started]When you press the button, you will be asked whether you want to import an existing wallet or create a new one. we are [Create a Wallet] Here are your options:

Step 4 Opting out of data collection

on the next page [No Thanks] By pressing the button you opt out of the collection of usage data (optional, you can choose one of the two here).

Step 5 Set a password

Next, you need to specify a password for your wallet. This password will be used to sign the transaction (to continue, specify a password and agree to the terms). This is not your private key.

Step 6 Watch training video

Next, the wallet will display an instructional video on seed key security. This video is highly recommended for new users or those creating seeds for the first time.

Step 7 Create a seed phrase

We now have a good understanding of the purpose and security practices associated with seed phrases. select [Next] Clicking on the button will display the creation of a new seed phrase and display any relevant warnings.

Step 8 Check the seed phrase

After publishing and keeping our seed phrase safe, [Next] You will be able to select a button. If you proceed from here, you will be prompted to verify your seed phrase as a final security check to ensure that you have saved it correctly. Simply select the words in the correct order and your seed phrase will be verified and [Confirm] You will be able to select a button.

Step 9 Wallet setup complete

Once selected, the final confirmation page will indicate that your wallet setup is complete. Here we choose [All Done] Your wallet is ready.

Step 10 Start using your wallet

If you want to receive funds (cryptocurrency or NFT), you can easily copy the public address from the top of your browser extension wallet.

The post Bitcoin – Maintaining the New Scope appeared first on Moralis Academy.